Homeowners Insurance in and around Coppell

If walls could talk, Coppell, they would tell you to get State Farm's homeowners insurance.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- Dallas

- Fort Worth

- Arlington

- Irving

- Flower Mound

- Lewisville

- Plano

- Frisco

- Mckinney

- Denton

- Carrollton

- Austin

- San Antonio

- Houston

- Texas

- Little Elm

- The Colony

- Waco

- Tyler

There’s No Place Like Home

With your home protected by State Farm, you never have to fret. We can help you make sure that in the event of damage from the unpredictable hail storm or burglary, you have the coverage you need.

If walls could talk, Coppell, they would tell you to get State Farm's homeowners insurance.

Give your home an extra layer of protection with State Farm home insurance.

Agent Willis Morrison Iii, At Your Service

Handling mishaps is made easy with State Farm. Here you can create a plan that's right for you or submit a claim with the help of agent Willis Morrison III. Willis Morrison III will make sure you get the thoughtful, high-quality care that you and your home needs.

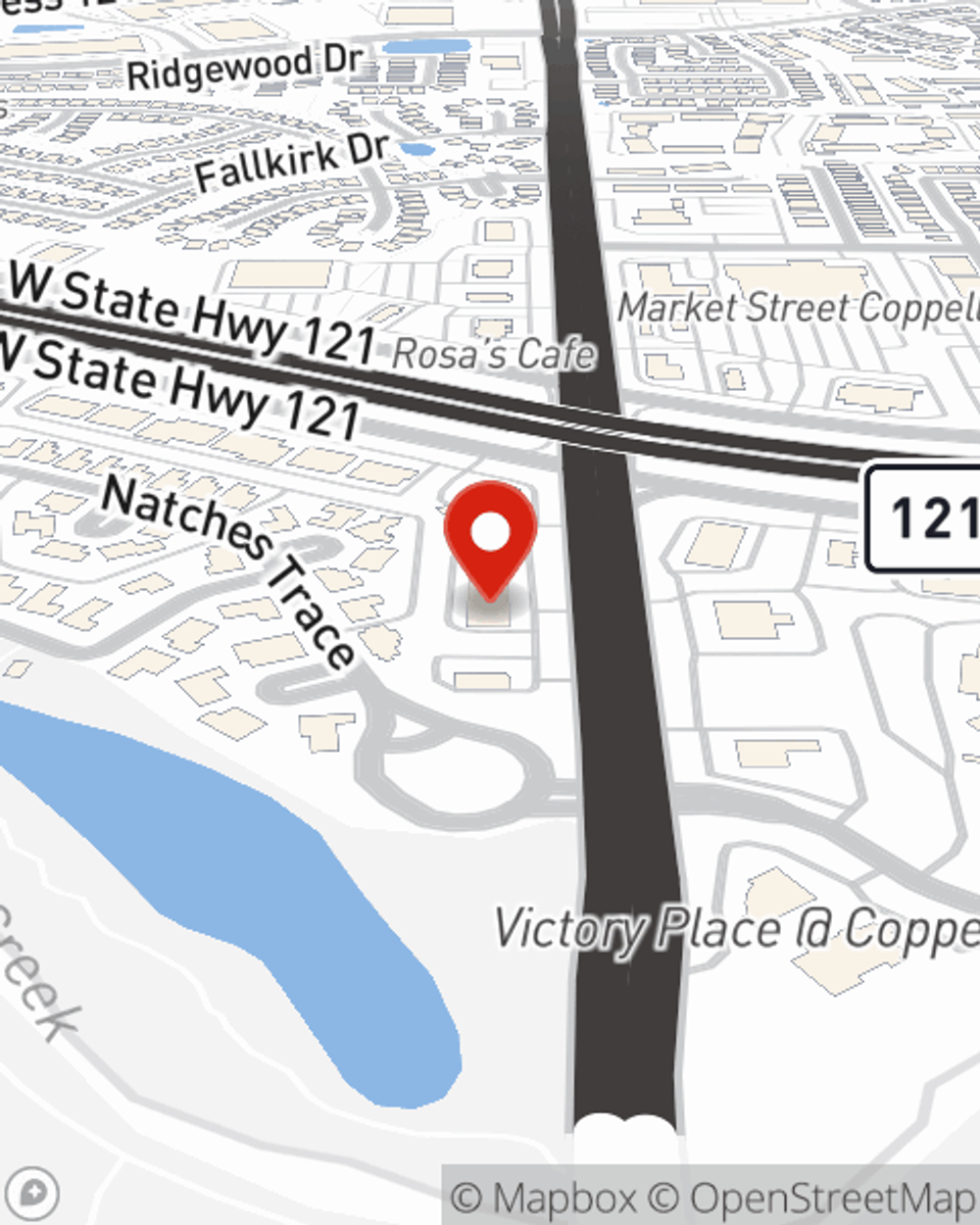

Get in touch with State Farm Agent Willis Morrison III today to find out how a leading provider of homeowners insurance can help protect your house here in Coppell, TX.

Have More Questions About Homeowners Insurance?

Call Willis at (972) 899-6570 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Willis Morrison III

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.